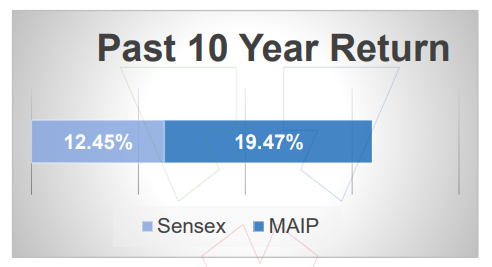

The MAiP strategy is a product offered by IJH Wealth. Investors can apply the MAiP strategy to their investments by onboarding with IJH Wealth, which has a presence both online and offline.

- Application of MAiP to existing portfolio – Investors can apply MAiP strategy in their existing portfolio by shifting their portfolio to IJH Wealth platform.

- New Investment – Investors who are wanting to start investing in mutual funds and want to apply MAiP strategy on their portfolio could directly onboard on IJH Wealth platform and start investing.

Investors have the option to onboard directly through the IJH Wealth website http://www.ijhwealth.com/ and application, available on the Play Store and App Store.

For further assistance, you can contact the support team at support@ijhacademy.com or connect with them at 7974060910.

Yes, it is chargeable and the cost is around 6,000 INR available to investors who choose to invest through IJH Wealth’s platform, as discussed above.